Why Doctors and Hospitals should outsource accounting?

Professional Expertise

By outsourcing your accounting operations to Virtual Accounting Service Providers, you get professional expertise by your side. Outsource your accounting operations to highly skilled professionals who understand the best practices on accounting, helps you to increase your productivity and your job becomes a lot easier than ever.

Minimize error Resulted in best quality Services

By outsourcing your accounting operations to Virtual Accounting Service Provider professionals, you get accuracy and better quality of services. Virtual Accounting Service Provider work for many clients, so they have more experience. If you outsource your operations to them, you can get the best quality of services with no errors.

Read More...

On-time assistance

Outsourcing your bookkeeping and accounting services to Virtual Accounting Service Providers can provide you on-time assistance. You also get on-time assistance for your financial reporting and tax compliance that saves you from tax penalties.

Get all services under one roof

By outsourcing your noncore operations to Virtual Accounting Service Providers, you can get all related services under one roof, including bookkeeping services, accounting services, payroll services, and taxation services.

Cost-Effective

This is one of the major benefits of outsourcing to Virtual Accounting Service Providers. By outsourcing bookkeeping and accounting operations, you can save extra overhead costs.

More time for you

Outsourcing accounting services to Virtual Accounting Service Providers can save hours for you. Think of all the things that you would have time to focus on now! You can have more time with your family, or more time investing in your business.

Real-time Accounting

Virtual Accounting Service Providers work in real-time. you can get real-time services on the go so that it can be accessed from anywhere and anytime.

Benefits of virtual accounting for Doctors

Less Paperwork, More Productivity Keeping track of paperwork and maintaining physical books can be challenging and time-consuming. it affects your business productivity. With Virtual accounting services, you can reduce paperwork and improve productivity.

Cloud Software is Always Improving Virtual accounting is based on cloud software and software companies bringing more advanced features as Bank feeds. it Imports your bank and credit card transaction in real-time and in just one click you can record transactions.

Read More...

Fully managed and monitored Virtual accounting services are provided by virtual accounting companies who have a lot of experience in Bookkeeping and Accounting Because it is their core business operation so they fully manage and monitor your Accounting operation.

Low cost Virtual accounting is better than an in-house accounting system. In house accounting system needs employees, their payrolls, Need office space, and use your resources but the virtual accounting team just need your data and there fees so you can save a lot of costs.

Less time Virtual accounting saves time from some of your operations like Accounting operations, Inventory management, client data management, etc. So you can gain significant time for Business.

Security Virtual accounting Provide data security. it Enhances the security of your Confidential data. it improves the security of customer's data as well like bank and credit card details etc.

Simplicity Virtual accounting simplifies the Accounting process of your business. It keeps track of your cash flows and transactions. by virtual accounting, you can Perform Full Cycle of Accounting including Accounts Payable, Accounts Receivables, Journal Entries, Monthly Accruals, Reconciliation, and financial reporting.

Services we provide for Doctors and hospitals

- Chart of account management.

- Multiple Bank accounts and Credit card feed management.

- Payments and Deposit transaction Entries with proper categorization.

- Billing and Invoicing management.

- Journal Entries Management.

- Payroll Management.

- Fixed assets and Liability Management.

- Batch Enter Transaction.

- Cash flow management.

- Bank Reconciliation and Account Reconciliation..

- Quarterly and annually financial Reporting.

- Tax Compliance management. (VAT, GST, SALES TAX, ETC).

What are the major responsibilities Doctors and Hospitals?

Undertaking patient and physical examinations It has been the major responsibility of every doctor and hospital to undertake every patient and do a physical examination.

Performing Surgical ProceduresDoctors and hospitals also have the responsibility to perform proper surgical procedure when needed.

Planning treatment requirementsDoctors and hospitals also have to plan the treatment requirement, depending on the patient.

Writing reports and maintaining recordsDoctors and hospitals also have to write every patient's report and maintain records properly.

Promoting health education Doctors and hospitals should promote health education for social welfare.

Keep up-to-date with medical developments, treatment and medication Doctors and hospitals keep themselves updated with the new medical developments, new treatment, and medications.

Bookkeeping and Accounting Doctors and Hospitals should do bookkeeping and accounting to know the hospital position in market.

Tax Compliance Management Doctors and Hospitals have to manage their tax compliance for paying taxes on time and get proper deductions on income.

Softwares We use

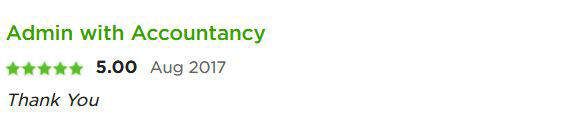

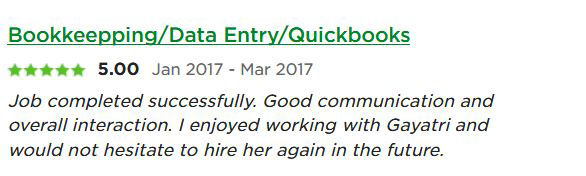

What our Client Say

Get Professional Accounting services

Save Accounting costs by 75%